Monday, January 26, 2026

How Everyday Performance Is Redefining Makeup

Trends Agency

Makeup has long been a fast-moving category shaped by frequent launches and evolving product claims. As prices rise and wallets tighten, consumer priorities are beginning to shift.

Shoppers are becoming more selective, gravitating toward products that fit easily into everyday routines rather than those built around heavy correction. This shows up in a preference for makeup that feels comfortable, wears well throughout the day, and integrates seamlessly into how consumers already get ready. For brands, this means products need to deliver clear, everyday benefits to stand out.

Makeup Spending Is Becoming More Selective

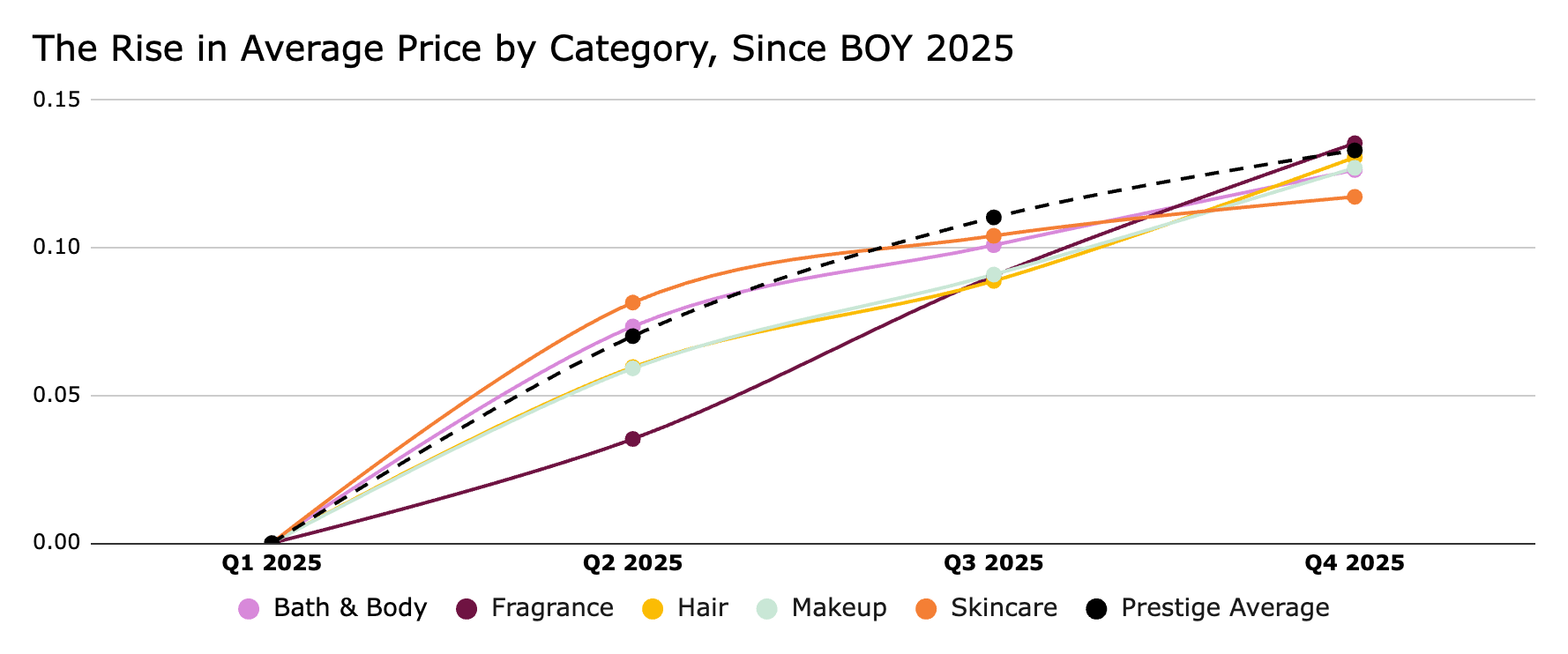

Makeup remains prestige’s most accessible category on price, with the lowest average list price across major categories (rising from $25.17 in Q1 2025 to $28.37 in Q4 2025). Even so, it’s not immune to inflation: makeup pricing climbed +5.9% by Q2, and ended the year +12.7% vs. BOY, keeping pace with broader prestige inflation (Prestige Average +13.3%). While category mix has stayed relatively stable, these steady price increases—especially in a historically “entry” category—raise the stakes on value perception and can shift how consumers allocate spend across beauty.

Our data shows that shoppers continue to invest in products like cheek, face and nail, which are showing growth in premium share. At the same time, brushes and tools are declining, while value sets are trending up — likely driven by holiday gifting and the appeal of bundled value. These patterns point to a more intentional approach to spending, where perceived usefulness is the most important factor.

This behavior reflects a shift toward prioritizing products that feel essential to daily routines. Items with frequent use are holding value, while those viewed as nonessential are increasingly easy to trade down or forego.

Comfort-First Benefits Gain Ground

One of the clearest signals in the makeup category is the growing preference for comfort-first benefits. Attributes such as hydration and longwear are gaining traction, while correction-focused and more clinical claims are losing share.

This shift is visible in our data, which shows gains for skincare benefits and longwear alongside declines in benefits tied to mattifying, pore minimizing, and skin perfecting. Rather than looking for intensive correction, consumers are favoring makeup that wears comfortably and performs consistently throughout the day — a trend reflected in top performers like Haus Labs’ Triclone Skin Tech Foundation (currently #1 in foundation at Sephora), which is positioned as a weightless, serum-like formula designed to help reduce redness while also protecting skin from environmental stress, all while delivering all-day wear.

Consumers Are Reassessing Value Across Beauty

The shift toward practicality is not unique to makeup. Across prestige beauty, pricing dynamics are showing up differently by category. Skincare and fragrance saw the sharpest early-year step-ups versus January, with skincare reaching ~+8% by Q2, while hair lagged initially before accelerating later in the year. By Q4, inflation had broadened across categories: fragrance (+13.5%) and hair (+13.1%) finished as the biggest movers versus January, while makeup (+12.7%) and bath & body (+12.6%) climbed steadily and tracked close to the prestige average (+13.3%). Skincare ended slightly below the pack at +11.7%, suggesting its pricing increases were more front-loaded, while fragrance and hair built momentum later.

Shoppers continued to adjust by simplifying routines and focusing on products that feel essential. In fragrance, consumers appear to be finding ways to manage spend through smaller formats and value-driven options, which may be contributing to softer average pricing.

For brands, this environment leaves less room for excess. Adding more claims or complexity is less effective when consumers are applying a tighter lens to what feels worth buying. Understanding which benefits continue to resonate, where consumers are still willing to invest, and how those preferences vary by subcategory and channel has become more important than ever.

AI-powered market insights help bring clarity to these shifts. By tracking performance at the SKU and category level, brands can see how consumer preferences are evolving and adjust product strategy and messaging accordingly.

Daash is a new, next generation commerce intelligence platform for the prestige beauty, personal care, and health & wellness industries. Think traditional intelligence tools but without the frustrating limitations. We’re enabling leading brands to track and understand the sales performance of competitor’s products and SKUs within brick & mortar retailers, including exclusive brands and products.